27+ mortgage rate amortization

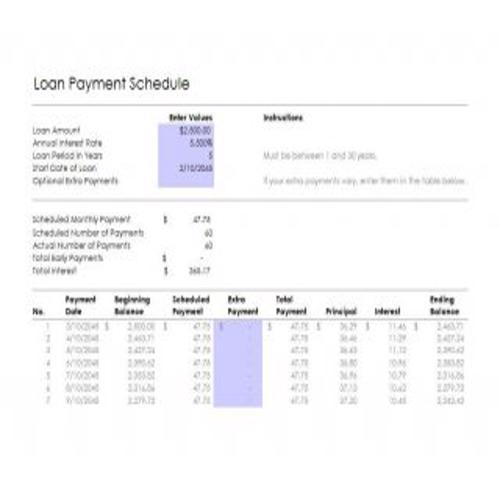

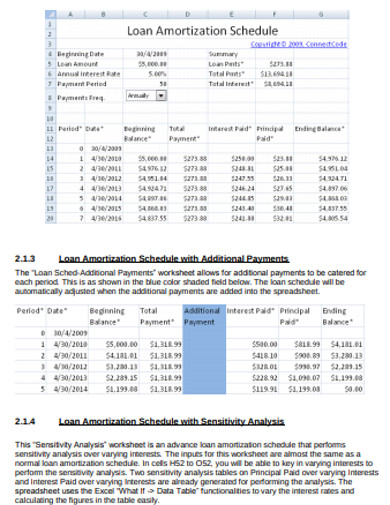

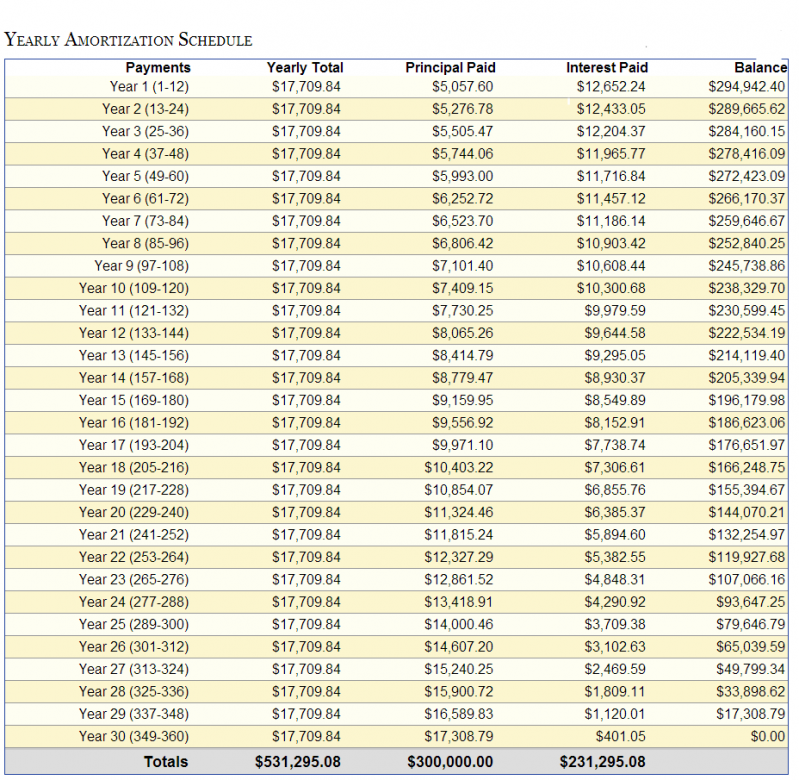

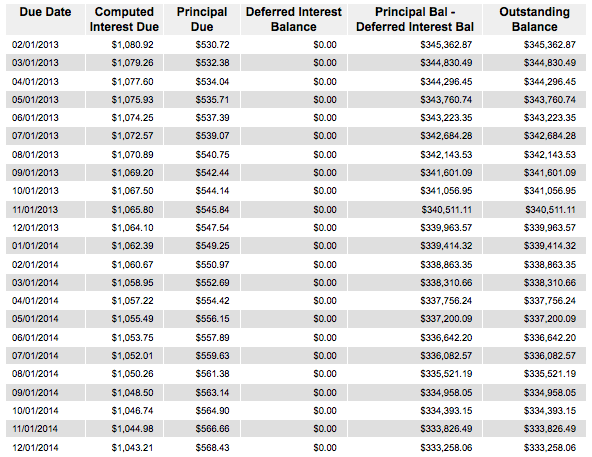

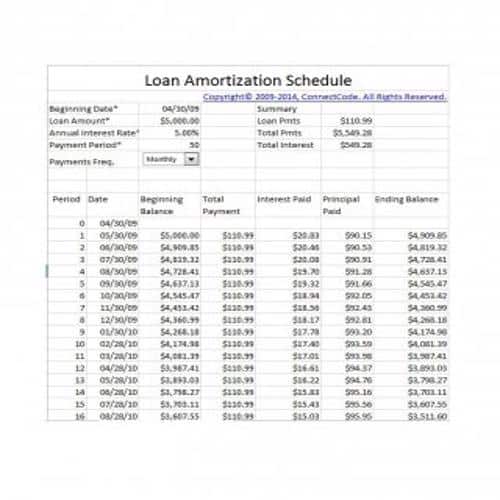

Web 122 rows A loan or mortgage amortization schedule is a table that shows borrowers their monthly loan payments. Web Payment Amount Principal Amount Interest Amount.

29 Editable Loan Amortization Schedule Templates Besty Templates

Our amortization calculator will help outline your payments by showing how much is going toward principal and interest over the life of your loan.

. Web Mortgage Amount Enter your mortgage amount. A portion of each installment covers interest and the remaining portion goes toward the loan principal. Apply Now With Quicken Loans.

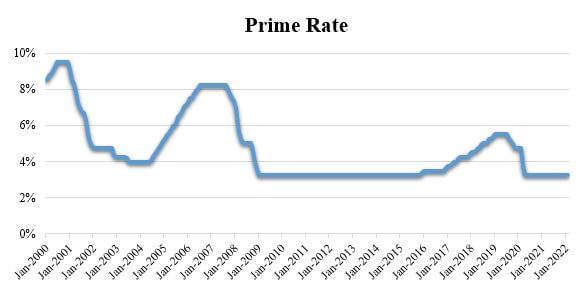

Web Generally amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages variable rate loans or lines of credit. At the time of renewal it is the remaining mortgage balance you are liable to pay your lender. Web We publish current Redmond personal loan rates to help borrowers compare rates they are offered with current market conditions and connect borrowers with lenders offering competitive rates.

See current rates Loan start date Calculator disclaimer. Amortization Enter the period over which you will repay the remaining amount to your mortgage provider. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Concerning a loan amortization focuses on. Web Mortgage amortization is a financial term that refers to the process of paying off your mortgage in monthly installments according to an amortization schedule. Spreading Costs Certain businesses sometimes purchase expensive items that are used for long periods of time that are classified as investments.

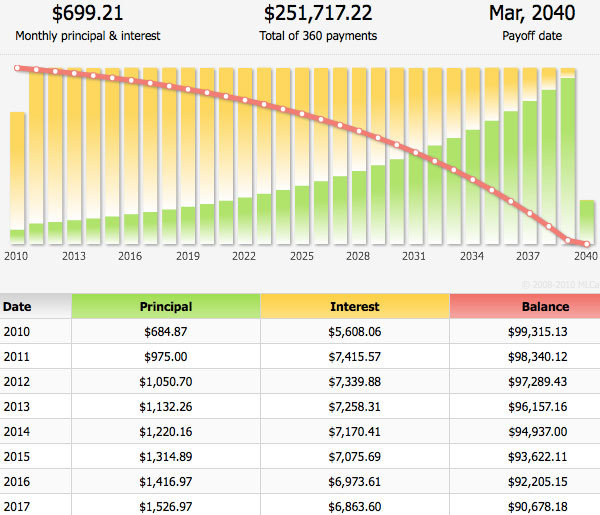

Web In an amortization schedule you can see how much money you pay in principal and interest over time. Web Adjust the graph below to see historical mortgage rates tailored to your loan program credit score down payment and location. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Our mortgage amortization calculator takes into account your loan amount loan term interest rate and loan start date to estimate the total principal and interest paid over the life of the loan. LOAN PROGRAMS 30 year fixed 20 year fixed 15 year fixed 10 year fixed 7-year ARM 5-year ARM 3-year ARM Loan purposePurchaseRefinance Credit rating740 or higher680 - 740Less than 680. Web Mortgage amortization shows how your loans principal and interest change over time.

Enter these values into the calculator and click Calculate to produce an amortized schedule of monthly loan payments. Web Amortization extra payment example. Initially most monthly payments go to paying interest rather than reducing the principal.

Bank Is One Of The Nations Top Lenders. Adjust the fields in the calculator below to see your mortgage amortization. Bank We Are Here To Help Provide a Simplified ARM Mortgage Experience.

Mortgage Rate Enter the interest rate at which you will secure your remaining. Check out todays mortgage rates. Say you are taking out a mortgage for 275000 at 4875 interest for 30 years 360 payments made monthly.

The average 30-year fixed mortgage rate rose for the fourth consecutive week eclipsing 7 for the first. Start by entering your mortgage amount interest rate and loan term to see. The monthly loan payment is determined by the loan amount interest rate and terms.

Compare Mortgage Options Get Quotes. Requiring a loan amortization calculator furnishes a tool for predicting what payments will be. Web Loan amortization is the process of scheduling out a fixed-rate loan into equal payments.

Web Thats a gross monthly income of 5000 a month. Ad Compare Mortgage Options Calculate Payments. Web Understanding the breakdown of your mortgage payments is a useful way to manage your debt and plan for your financial goals.

Paying an extra 100 a month on a 225000 fixed-rate loan with a 30-year term at an interest rate of 3875 and a down payment of 20 could save you 25153 in interest over the full term of the loan and you could pay off your loan in 296 months vs. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including principal interest taxes and. You can see that the payment amount stays the same over the.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Get Started Now With Quicken Loans.

Web Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. Use this calculator to input the details of your loan and see how those payments break down.

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

Sales Jobs Retention Purchase Servicing Reverse Products Webinars And Training Interview With Economist Elliot Eisenberg

Adjustable Rate Vs Fixed Rate Mortgage Calculator

Amortization Schedule Calculator Nerdwallet

How 30 Year Mortgages Get Paid Off Wake County Home Buyers

Loan Schedule 15 Examples Format Pdf Examples

Prime Rate Breaking And Uses Of Prime Rate With Example

Reverse Mortgage Amortization Schedule

Adjustable Rate Vs Fixed Rate Mortgage Calculator

Negative Amortization Example And Definition

Amortization Schedule Over 30 Years Saverocity Finance

Amortization Calculator Casaplorer Com

Amortization Calculator Amortization Schedule

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Mortgage Amortization Schedule Xlsx

29 Editable Loan Amortization Schedule Templates Besty Templates

How To Save 100000 On Your Next Mortgage Loan Nrvliving Real Estate Simplified